Land contracts are a means of getting a home without a mortgage. Leases with the option to purchase and rent-to-own housing contracts are additionally methods of buying a home without a mortgage. To get more information about those sorts of contracts, read Leases with the Alternative to Buy and Rental Fee to Own Contracts.

While not having a home loan might appear great, land agreements typically have less securities for customers than home loans. Land contracts normally include private vendors, not a bank or other banks. A land contract should outline what the buyer and seller are expected to do. It will likewise claim what will take place if one celebration breaches (does not follow) the agreement.

What is a Land Agreement?

A land contract is an agreement between a customer and personal vendor genuine building that has a home on it. With a land agreement, the purchaser does not obtain full ownership of the building. The buyer is an owner, yet they only obtain ‘equitable title’ of the residential or commercial property.by link michigan 4652 website Equitable title is the right to obtain full ownership of property. This is different from legal title, which is actual ownership of property. The customer will not get legal title up until the complete purchase rate is paid.

Land agreements can make residential or commercial property easier to offer because the seller decides the credit score needs and deposit amount. The celebrations can additionally work out the monthly repayments, including whether there will certainly be a balloon settlement. A balloon repayment is an abnormally huge repayment due at the end of the acquisition duration. The events will additionally settle on the interest rate. Nonetheless, in Michigan the interest rate can not be above 11%. It is feasible for the rates of interest to alter with time, yet the ordinary rate of interest has to be 11% or much less.

In general, the customer is in charge of making all repair services and paying property taxes in many land agreements. Many contracts additionally say the buyer has to get property owners insurance coverage.

What Occurs if the Purchaser Breaches the Contract?

The most common kind of land contract breach by a buyer involves payment concerns. Any type of missed or partial payment can create problems for the customer. If a customer misses out on a settlement or doesn’t make the entire payment, the vendor can take action. One of the most typical action (called a ‘solution’) a seller takes is to forfeit (terminate) the agreement. A much less usual solution is repossession. A vendor can utilize either remedy for any type of violation of the contract.

The Seller Can Waive the Contract

Most land contracts have a forfeiture provision. A loss condition generally says that if the purchaser breaches the contract, the seller can keep all cash paid to it. The vendor can also reclaim ownership of the home. The seller can not waive the contract without a forfeit condition.

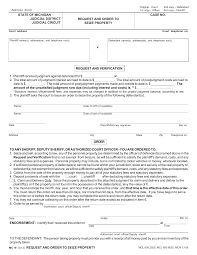

The primary step in the loss process is for the seller to send the purchaser a forfeiture notification. The notification can be served in either of the following ways:

- In person, by giving it to the customer or someone living in the home old enough to approve it, with guidelines to give it to the purchaser

- By first-class mail to the customer’s last known address

This notification must give the customer at the very least 15 days to heal (fix) the breach. The purchaser can treat a settlement breach in a forfeit by paying the amount behind (all the past due settlements). The buyer might likewise willingly move out and give up the home. The buyer can not be forced to move out up until much later on at the same time.

If the purchaser willingly vacates, this does not treat the breach. The vendor might still begin a court case. The only way to heal the breach is to pay the quantity behind or address the breach in another way. However, the seller may just want getting the home back.

If the 15 days pass and the purchaser does not heal the violation or move out, the vendor can begin a litigation. They need to file a summons and issue in area court and offer a copy on the buyer. The problem has to list all of these:

- The original market price

- The balance staying

- The quantity in arrears (overdue)

- A statement explaining any other breaches that would sustain a forfeiture

The vendor must likewise affix a copy of the notice of forfeiture, showing when and exactly how it was offered.

The buyer should react to the complaint. If the buyer does not, the court might enter a default judgment against them. A default judgment means the vendor might get whatever they request without a judge ever before hearing from the buyer. The summons needs to have the day the customer requires to visit court. The buyer can litigate and vocally react at the hearing or submit a created response or movement with the court. It is best to file a created solution or motion prior to mosting likely to the hearing, but that is not required.

In a payment breach case, if the judge policies for the seller, they will provide a judgment for the amount it figures out is past due. The buyer will certainly be able to maintain the home by paying the seller or the court the quantity provided due in the loss judgment. The quantity of time the customer has to make the repayment is called the redemption duration. The redemption duration is 90 days if the purchaser has actually paid less than 50% of the land contract. If the customer has actually paid 50% or more of the land contract, the redemption duration is six months. The seller can’t evict the customer till after the redemption duration is over.

Any type of payments the customer makes throughout the redemption duration ought to initially be put on the judgment quantity. If the purchaser makes payment(s) during the redemption period, there need to be a hearing prior to the vendor can get an order of eviction. Even if the customer doesn’t make brand-new normal monthly settlements that come due throughout the redemption period, they can not be kicked out. However, the vendor might submit another forfeiture instance if those payments stay unsettled after the judgment is paid off.

If a forfeit judgment is entered versus the buyer, and they intend on leaving the home, they might pick to not make their normal repayments during the redemption duration. If the seller only intends to recuperate the home, after that not making the common regular monthly payment may be an excellent plan. Nevertheless, the seller might choose to seek damages from the purchaser under the contract.

What Happens When the Seller Breaches the Contract?

A common means land agreement vendors breach the agreement is by rejecting to move title of the home when the purchaser pays off the agreement equilibrium. When this occurs, the buyer can file a ‘silent title’ grievance in circuit court. This asks the judge to either order the vendor to move title to the home or declare that the purchaser is the titleholder. The buyer can only do this after making the final settlement.

The purchaser could additionally file a problem asking the court to cancel or ‘rescind’ the agreement. If the agreement is rescinded, the customer would be qualified to get back cash paid to the seller. The purchaser would then need to surrender any insurance claim to ownership of the home.

Both of these actions are intricate. You might wish to speak to an attorney if you are considering beginning one of these lawsuits. Utilize the Overview to Legal Assistance to find attorneys or a legal solutions workplace in your area.

Usual Concerns for Buyers in Land Contracts

Prior to a buyer indicators a land contract, they ought to do a title search at their county’s Register of Deeds to see to it the vendor has excellent title to the home. There could be existing liens on the property or other points that limit a purchaser’s legal rights to the building. If the vendor has tidy title, the customer may wish to tape their passion in the property at the Register of Deeds to make sure their interest is shielded.

Sometimes homes available for sale by land agreement need a lot of repair work. Prior to signing the agreement, the customer should extensively examine the home to see what repairs are needed. It is best to have a specialist do this due to the fact that many land contracts require the buyer to make all repairs and preserve the home.

A buyer needs to beware with subordination agreements. These arrangements permit the seller to offer others rate of interest in the residential property that is superior to purchaser’s. If you have concerns about these agreements, you should speak to a lawyer. If you have a low earnings, you might qualify for cost-free legal solutions. Whether you have a low earnings or otherwise, you can utilize the Guide to Legal Help to locate legal representatives in your location. If you are not able to secure free legal solutions but can’t manage high lawful charges, take into consideration employing an attorney for part of your case rather than the whole thing. This is called limited extent depiction. To get more information, check out Restricted Range Representation (LSR): An Even More Economical Means to Employ a Lawyer. To discover a minimal extent lawyer, follow this web link to the State Bar of Michigan lawyer directory site. This link lists lawyers that use minimal range depiction. You can narrow the results to legal representatives in your location by inputting in your region, city, or zip code on top of the page. You can additionally narrow the outcomes by subject by getting in the kind of attorney you need (separation, estate, and so on) on top of the page.